What is the DA data strategy?

Changes in the market landscape and a wider focus on delegated authority performance have highlighted the need for a strategy specifically focused on delegated authority data.

The DA data strategy sets out three key areas of focus: data transmission mechanisms; performance management; and data standards for reporting.

Why we have developed the strategy

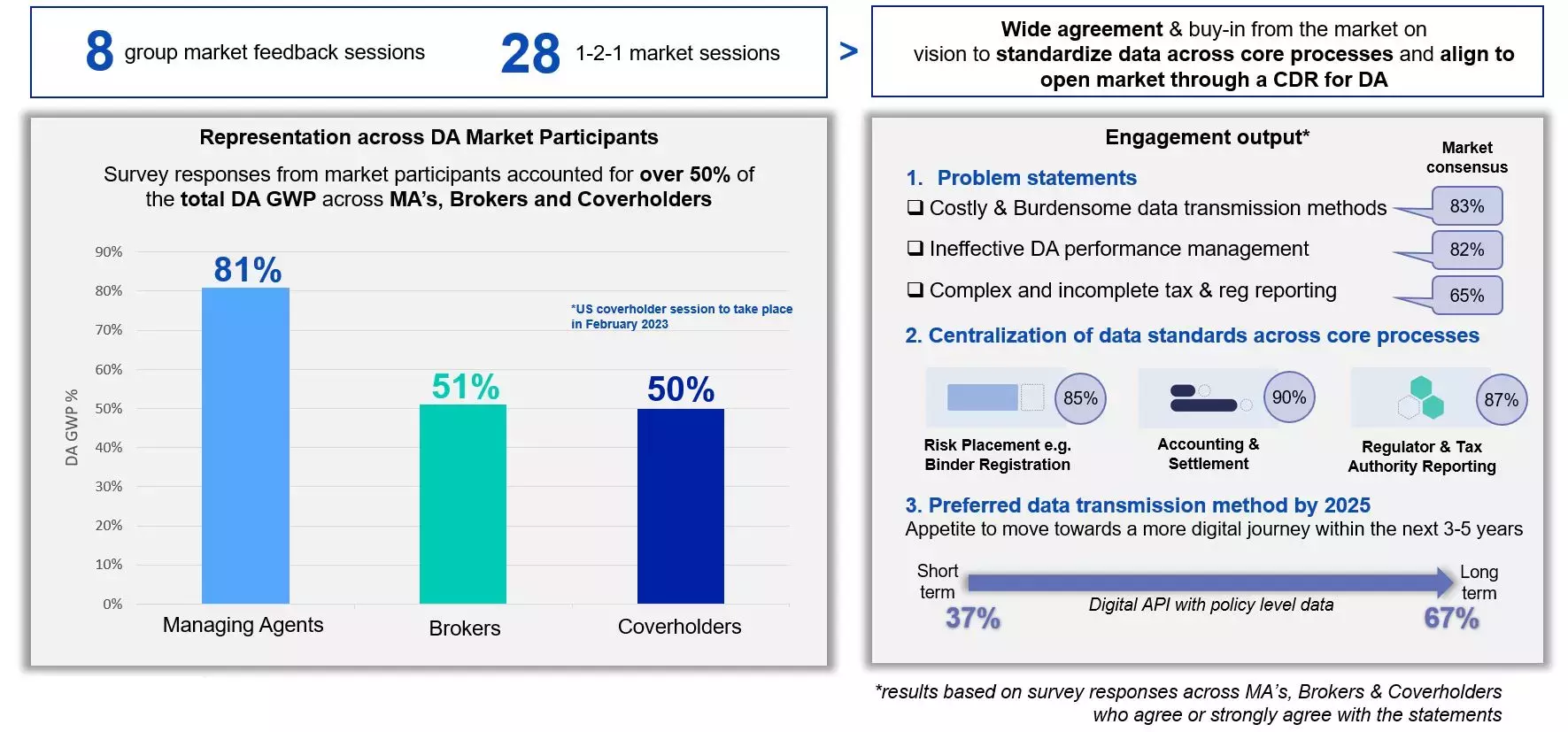

In Q4 2022, we spoke to the market to understand the key challenges they face in relation to delegated authority data.

The key themes included:

Progress in open market data standards

The Data Council’s agreement of the MRC v3 and CDR for the open market has laid the foundation to develop a single data standard for delegated authority business.

Innovation agenda and scaling changes within managing general agents (MGA)

MGAs are increasingly adopting digital-first approaches to improve customer experience and reduce costs.

Market-wide performance focus

Performance improvement across the value chain is a priority for Lloyd’s, timely access to reliable data is required to achieving this goal.

Research findings

Research findings from our market engagement led to the identification of three main issues and it was agreed that the priority should be to focus on:

-

Data transmission mechanisms

-

Performance management

-

Data standards for reporting

Addressing these problems could resolve issues related to poor data quality and overly complex processes which add cost and burden to all parties within the distribution chain.

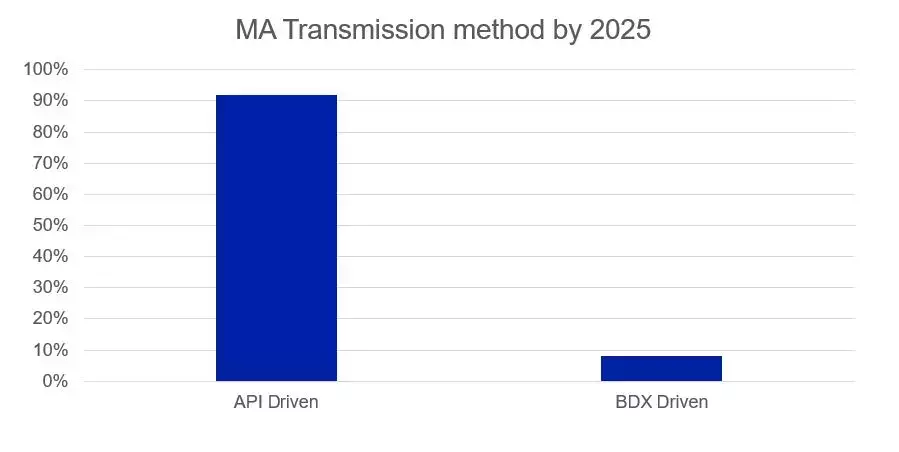

Adoption insights demonstrate a strong market appetite for a digital-led journey over the next three to five years.

Key considerations

There are several key considerations for the market to adopt a data-first approach for doing business:

Phased implementation approach

Implementation will need to be phased, to support adoption and pace of individual market participants.

Market change required for adoption

Market participants will require technical and business process transformation to enable adoption of API standards and transmission methods.

Iterative development and market testing

The DA data standard will need to be built up iteratively, starting with binder placement data captured via a computable BAA, with regular market testing to ensure standards are fit for purpose and support the end-to-end DA journey.

Strategic response

Following engagement with the market and key associations, a set of guiding principles has been established which serve as the foundation of the DA data strategy:

-

Using a single data standard for both open market and DA business will reduce complexity and cost

-

Work has already been done to create an open market set of messaging standards for Risk (CDR), Premium & Accounting (EBOT), and Claims (ECOT) providing an opportunity to leverage this for delegated forms of business

Action: We’ve been working with the LMG Data Council and the Delegated Authority Council (DAC) through Q2 and Q3 2023 to investigate whether the open market data standards could serve the market, and what the implications might be.

-

The primary focus should be on developing services that support the transmission of data more efficiently and effectively

-

Data rationalisation is key, asking for data once and re-using it wherever possible by connecting systems together rather than re-collecting the same information multiple times

Action: We’re working with Velonetic to replan ‘sequence four’, the part of the Joint Solution Plan focused on DA business to enable this principle. An updated plan is due in Q4 2023

-

Many market participants would prefer to select their own technology vendor to fit with their wider technology architecture

-

They also want choice in their distribution chain; some coverholders operate via direct deal, while many brokers play a key role as data processer, therefore both data flows need to be unlocked

Action: Remove the mandate on DDM usage in the Lloyd’s market and allow firms to choose the technology platforms and solutions that best suit their needs. (Please note: the Lloyd’s Europe (LIC) mandate for DDM will remain, as this is LIC’s chosen bordereaux solution for the time being).